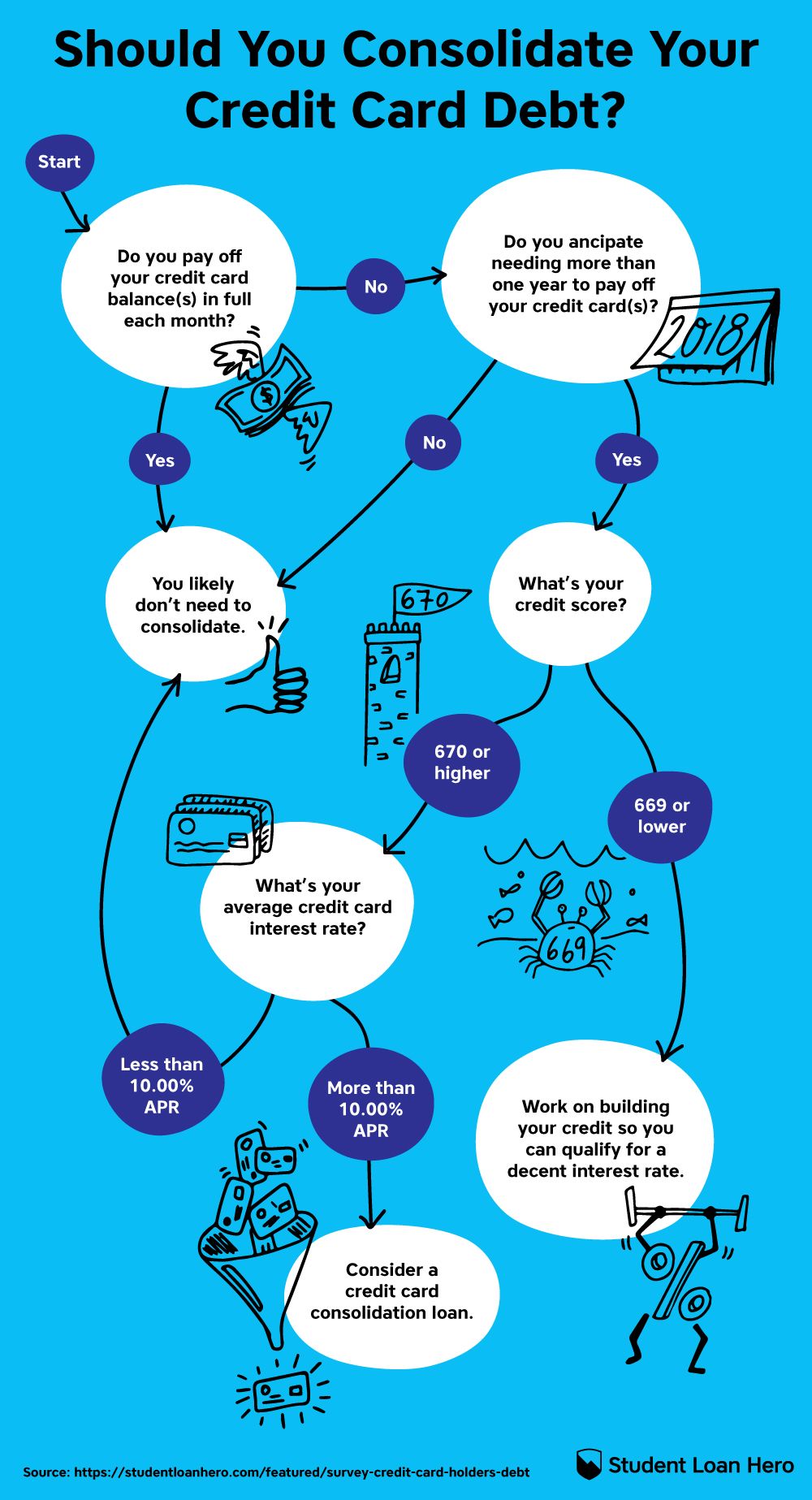

Consolidation loans can be used to reduce debt by consolidating several smaller loans. You will need to identify each debt obligation and apply for a loan. Once the loan is approved, you will be able to pay off all other debts within a specific payment period. For example, if your obligation is Rs 3000000, there are two loans available: a 2-year loan of Rs 1000000 at 12.5% interest and a 10-year loan of Rs 2000000 at 10%.

Unsecured loans can't be consolidated with an unsecured loan

Unsecured loans can be secured with collateral but they can still have serious consequences if you fail to make your payments. Late fees and additional interest charges will be assessed for missed payments. Late payments will appear on your credit reports for seven years. In some cases, your account may be put into collections. Although it might seem bad, unsecured loans are an option that can help you repay debt.

If you find yourself in default on your unsecured loans, the best thing is to contact your lender and explain your financial situation. The lender may offer assistance in repaying your debt, such as lowering the monthly payment or waiving over-the-limit fees. In an emergency, some lenders will lower your interest rate temporarily.

Unsecured Loans require income proof

You will need proof of income to get an unsecured loan. The lender will look at your income and credit history to determine if you can afford the loan. The amount of debt that you have relative to your income will also determine the interest rate. You can get a lower interest rate if your credit score is good. If you intend to obtain a larger personal loan, proof of income may be required.

You can use bank statements, pay stubs, or tax returns to prove your income. Other financial information may be required by lenders, such as proof that you have received benefits. Be sure to check with your lender to make sure you'll be able to provide all the information that you need.

Consolidating unsecured loans with an unsecured loan is possible

You have the option of applying for an unsecured loan to consolidate debt. It is flexible and easier than you might think. Unsecured loans can be applied online or in person. These loans are offered by many different lenders. These include local banks and credit unions. However, unsecured loans may also be available from other financial institutions like insurance companies and peer to-peer lenders.

Unsecured loans are not tied to collateral. Your lender cannot take your assets if your defaults. Failure to pay a loan on a timely basis can result in a severe reduction of your credit score, which is often measured using a number called FICO. Low credit scores can make it more difficult to get credit or even lead to foreclosure.

Student loan consolidation

Consolidating multiple student loans into a single loan is called student loan consolidation. This can help to reduce monthly payments as well as lengthen loan terms. Consolidation loans are available through the Federal Direct Student Loan Program. Consolidating student loan debts has many advantages. Consolidating student loans can have many benefits. For example, you will get a lower interest rate, a longer term, and fewer payments.

Consolidating your student loans is a great way to get out of the cycle of multiple payments each month. You can be more organized by only having one bill each month. This will allow you to stay on track and pay your bills on time. Multi-loan debt can make it difficult and easy to miss one payment. However, student loan consolidation can help to manage your finances and make sure that your payments are on time. It is possible to have negative credit scores by late payments, even if you don't know it.

Consolidation of home equity loans

You can consolidate debts by taking out a home equity mortgage. This type of loan has lower interest rates and payments. However, you need to weigh the risks and advantages of this loan before you take it out. If your circumstances change, your home may be at risk. It is important that you consider all possible options before you take out a home equity mortgage.

A home equity line credit is another option to consolidating your home equity loan. These loans can be revolving credit lines that let you borrow against your home to repay your debts. A home equity loan is not like a traditional loan. It has fixed interest rates so you can use it for any purpose. You should look into other options for debt consolidation if you are in too much debt or have not enough equity to be eligible for a home equity line of credit.

FAQ

Why is personal finance so important?

A key skill to any success is personal financial management. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why then do we keep putting off saving money. Is there nothing better to spend our time and energy on?

Yes and no. Yes, most people feel guilty saving money. Yes, but the more you make, the more you can invest.

Focusing on the big picture will help you justify spending your money.

You must learn to control your emotions in order to be financially successful. Negative thoughts will keep you from having positive thoughts.

You may also have unrealistic expectations about how much money you will eventually accumulate. This could be because you don't know how your finances should be managed.

After mastering these skills, it's time to learn how to budget.

Budgeting means putting aside a portion every month for future expenses. Planning will save you money and help you pay for your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

What is the limit of debt?

It is essential to remember that money is not unlimited. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. You should cut back on spending if you feel you have run out of cash.

But how much do you consider too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. This will ensure that you don't go bankrupt even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. If you make $20,000, you should' t spend more than $2,000 per month. If you earn $50,000, you should not spend more than $5,000 per calendar month.

It's important to pay off any debts as soon and as quickly as you can. This includes credit card bills, student loans, car payments, etc. Once those are paid off, you'll have extra money left over to save.

It's best to think about whether you are going to invest any of the surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. You can still expect interest to accrue if your money is saved.

For example, let's say you set aside $100 weekly for savings. This would add up over five years to $500. After six years, you would have $1,000 saved. You'd have almost $3,000 in savings by the end of eight years. By the time you reach ten years, you'd have nearly $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. It's impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 in savings, you would have more than 57,000.

It's crucial to learn how you can manage your finances effectively. A poor financial management system can lead to you spending more than you intended.

How does rich people make passive income from their wealth?

There are two main ways to make money online. One is to create great products/services that people love. This is what we call "earning money".

A second option is to find a way of providing value to others without creating products. This is called "passive" income.

Let's say you own an app company. Your job involves developing apps. Instead of selling apps directly to users you decide to give them away free. Because you don't rely on paying customers, this is a great business model. Instead, you rely upon advertising revenue.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is how the most successful internet entrepreneurs make money today. Instead of making money, they are focused on providing value to others.

What is the fastest way to make money on a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You must also find a way of establishing yourself as an authority in any niche that you choose. It's important to have a strong online reputation.

Helping others solve problems is the best way to establish a reputation. Consider how you can bring value to the community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

When you really look, you will notice two main side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has its pros and cons. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

However, you may not achieve the level of success that you desire unless your time is spent building relationships with potential customers. Additionally, there is intense competition for these types of gigs.

Consulting allows you to grow and manage your business without the need to ship products or provide services. It takes more time to become an expert in your field.

If you want to succeed at any of the options, you have to learn how identify the right clients. It will take some trial-and-error. But, in the end, it pays big.

What is personal financing?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

By mastering these skills, you'll become financially independent, which means you don't depend on anyone else to provide for you. You don't need to worry about monthly rent and utility bills.

And learning how to manage your money doesn't just help you get ahead. It makes you happier overall. When you feel good about your finances, you tend to be less stressed, get promoted faster, and enjoy life more.

So who cares about personal finance? Everyone does! The most searched topic on the Internet is personal finance. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

People use their smartphones today to manage their finances, compare prices and build wealth. They read blogs such this one, listen to podcasts about investing, and watch YouTube videos about personal financial planning.

According to Bankrate.com Americans spend on average four hours per day watching TV, listening and playing music, browsing the Internet, reading books, and talking to friends. It leaves just two hours each day to do everything else important.

When you master personal finance, you'll be able to take advantage of that time.

What side hustles will be the most profitable in 2022

The best way today to make money is to create value in the lives of others. You will make money if you do this well.

While you might not know it, your contribution to the world has been there since day one. When you were a baby, you sucked your mommy's breast milk and she gave you life. You made your life easier by learning to walk.

Giving value to your friends and family will help you make more. In fact, the more you give, the more you'll receive.

Without even realizing it, value creation is a powerful force everyone uses every day. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

In actuality, Earth is home to nearly 7 billion people right now. Each person creates an incredible amount of value every day. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. That's a huge increase in your earning potential than what you get from working full-time.

Now let's pretend you wanted that to be doubled. Let's say you found 20 ways to add $200 to someone's life per month. Not only would you make an additional $14.4million dollars per year, but you'd also become extremely wealthy.

Every day, there are millions upon millions of opportunities to create wealth. This includes selling information, products and services.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. Helping others achieve theirs is the real goal.

Create value to make it easier for yourself and others. Use my guide How to create value and get paid for it.

Statistics

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

Passive Income Ideas To Improve Cash Flow

You don't have to work hard to make money online. Instead, there are passive income options that you can use from home.

There may be an existing business that could use automation. Automation can be a great way to save time and increase productivity if you're thinking of starting a new business.

Automating your business is a great way to increase its efficiency. This will allow you to focus more on your business and less on running it.

Outsourcing tasks can be a great way to automate them. Outsourcing allows you and your company to concentrate on what is most important. By outsourcing a task you effectively delegate it to another party.

This allows you to focus on the essential aspects of your business, while having someone else take care of the details. Outsourcing can make it easier to grow your company because you won’t have to worry too much about the small things.

Turn your hobby into a side-business. You can also use your talents to create an online product or service. This will help you generate additional cash flow.

You might consider writing articles if you are a writer. You have many options for publishing your articles. These websites allow you to make additional monthly cash by paying per article.

It is possible to create videos. Many platforms now enable you to upload videos directly to YouTube or Vimeo. These videos will bring traffic to your site and social media pages.

You can also invest in stocks or shares to make more money. Investing in stocks and shares is similar to investing in real estate. You are instead paid rent. Instead, you receive dividends.

As part of your payout, shares you have purchased are given to shareholders. The size of the dividend you receive will depend on how many stocks you purchase.

If you decide to sell your shares, you will be able to reinvest the proceeds into new shares. You will still receive dividends.