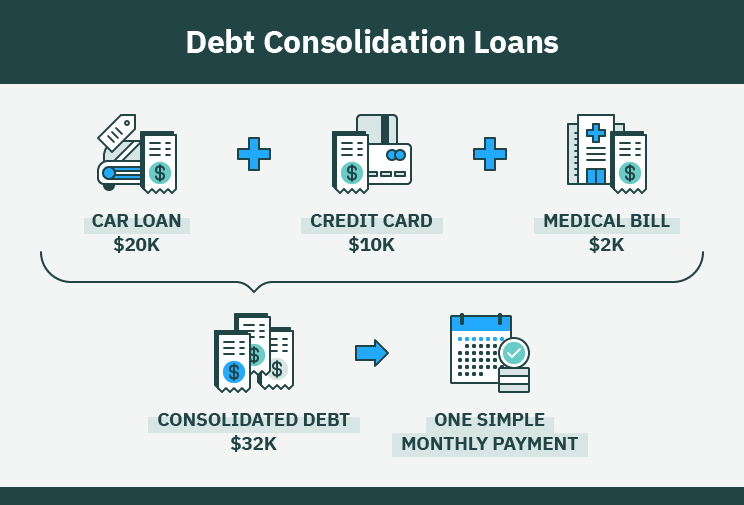

Consolidating debt is a financial strategy that allows multiple debts to be paid off with one loan. This can lower your interest rate, while protecting your credit. It is a popular option for consumers who don't want to file for bankruptcy. However, it is not the right choice for everyone.

A financial strategy that consolidates multiple debts into one loan, called debt consolidation.

Consolidating multiple debts into one loan is a financial strategy to reduce interest rates, simplify repayment plans and lower your monthly payments. Debt consolidation works best when your spending is under control and your credit score is good enough to qualify for a competitive interest rate. This is also a good option if you have a low-cost amount of debt that you can pay off in a matter of months.

However, there are certain guidelines you need to meet before pursuing debt consolidation. To qualify for the best interest rates and terms, you must have good credit ratings. You might not be able qualify for the best rates if your financial situation is dire. Lenders are also becoming more cautious due to the economic downturn, which means their credit standards are increasing.

It can increase your credit score

Consolidating debt can help you keep your credit cards, and allow you to continue using credit lines. Credit card companies will close your account if the bankruptcy is filed. This is often the last choice for people who have significant debt. This can be detrimental to the purpose and effectiveness of debt consolidation. Debt consolidation also simplifies debt management by eliminating the need for separate payments to creditors with different interest rates.

Consolidation plans will show up on your credit reports, but they shouldn't have a major effect on your score. Debt consolidation plans won't lower your credit score, according to most scoring models. Your credit score can be affected if your debt consolidation plan includes cancelling credit cards. Your credit score will improve as time passes. Keep in mind that 35% of your credit score is determined by your payment history.

It can help protect your credit

It's important that you weigh all your options when protecting your credit. While bankruptcy will wipe out all of your debts and ruin your credit for seven to ten years, debt consolidation may be a better option. Consolidating your debt means that you take out a new loan, or line of credit, with better terms than the one you currently have. This will help reduce your late payments, fees, and rebuild your credit.

The impact it has on your credit rating is one of many differences between debt consolidation bankruptcy. Consolidating all of your debts onto one account is possible if you don’t use your credit cards as much. This will lower both your monthly payment, and your interest rate. It will also lower your credit score if payments are not made on time. Excessive spending habits are another problem that debt consolidation won't solve.

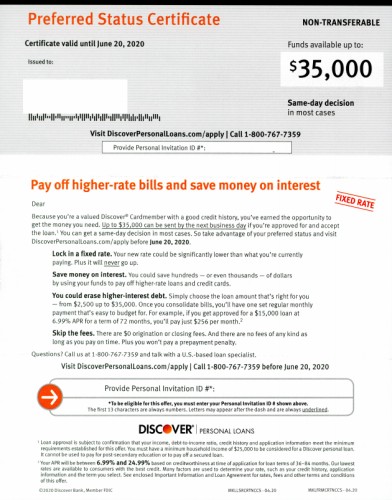

It can lower interest rates

Consolidating debt may lower interest rates and improve credit scores. However, bankruptcy can make it difficult to obtain loans. In addition, a bankruptcy judgment is public record and any lender or potential employer can find out about it. A bankruptcy's effects can be severe and last for years. It is best to seek the advice of a credit counselor in order to decide which route is best for you. The Federal Trade Commission recommends using a nonprofit organization that is accredited by the National Foundation for Credit Counseling. Avoid high-pressure salespeople who may con you.

Consolidating debt will also reduce the amount of payments you need to make each month. This will make budgeting easier and lower the chance of missing one or more payments. You can also combine debts with one loan to get lower interest rates and lower monthly repayments.

FAQ

How does rich people make passive income from their wealth?

There are two methods to make money online. You can create amazing products and services that people love. This is known as "earning" money.

You can also find ways to add value to others, without having to spend your time creating products. This is "passive" income.

Let's suppose you have an app company. Your job is to create apps. But instead of selling the apps to users directly, you decide that they should be given away for free. Because you don't rely on paying customers, this is a great business model. Instead, advertising revenue is your only source of income.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is the way that most internet entrepreneurs are able to make a living. Instead of making money, they are focused on providing value to others.

What is personal financing?

Personal finance involves managing your money to meet your goals at work or home. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You don't need to worry about monthly rent and utility bills.

It's not enough to learn how money management can help you make more money. It makes you happier overall. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

What does personal finance matter to you? Everyone does! The most searched topic on the Internet is personal finance. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

People use their smartphones today to manage their finances, compare prices and build wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com reports that Americans spend four hours a days watching TV, listening, playing music, playing video games and surfing the web, as well as talking with their friends. It leaves just two hours each day to do everything else important.

Personal finance is something you can master.

How can a beginner make passive income?

Start with the basics. Learn how to create value and then discover ways to make a profit from that value.

You might have some ideas. If you do, great! You're great!

You can make money online by looking for opportunities that match you skills and interests.

There are many ways to make money while you sleep, such as by creating websites and apps.

You might also enjoy reviewing products if you are more interested writing. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. If you enjoy it, you will stick with the decision for the long-term.

Once you have discovered a product or service that you are passionate about helping others purchase, you need to figure how to market it.

You have two options. The first is to charge a flat-rate for your services (like freelancers) and the second is per project (like agencies).

Either way, once you have established your rates, it's time to market them. This means sharing them on social media, emailing your list, posting flyers, etc.

Keep these three tips in your mind as you promote your business to increase your chances of success.

-

Market like a professional: Always act professional when you do anything in marketing. It is impossible to predict who might be reading your content.

-

Know what your topic is before you discuss it. Fake experts are not appreciated.

-

Do not spam. If someone asks for information, avoid sending emails to everyone in your email list. Send a recommendation directly to anyone who asks.

-

Use a good email service provider. Yahoo Mail or Gmail are both free.

-

You can monitor your results by tracking how many people open your emails, click on links and sign up to your mailing lists.

-

Measuring your ROI is a way to determine which campaigns have the highest conversions.

-

Get feedback - Ask your friends and family if they are interested in your services and get their honest feedback.

-

Try different strategies - you may find that some work better than others.

-

Keep learning - continue to grow as a marketer so you stay relevant.

What is the difference in passive income and active income?

Passive income can be defined as a way to make passive income without any work. Active income requires hard work and effort.

Active income is when you create value for someone else. Earn money by providing a service or product to someone. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great as it allows you more time to do important things while still making money. However, most people don't like working for themselves. People choose to work for passive income, and so they invest their time and effort.

Passive income doesn't last forever, which is the problem. You might run out of money if you don't generate passive income in the right time.

Also, you could burn out if passive income is not generated in a timely manner. It's better to get started now than later. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types of passive income streams:

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

What's the best way to make fast money from a side-hustle?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

Also, you need to figure out a way that will position yourself as an authority on any niche you choose. It's important to have a strong online reputation.

The best way to build a reputation is to help others solve problems. So you need to ask yourself how you can contribute value to the community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

If you are careful, there are two main side hustles. The one involves selling direct products and services to customers. While the other involves providing consulting services.

Each approach has its pros and cons. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

You might not be able to achieve the success you want if you don't spend enough time building relationships with potential clients. These gigs can be very competitive.

Consulting is a great way to expand your business, without worrying about shipping or providing services. However, it takes time to become an expert on your subject.

To be successful in either field, you must know how to identify the right customers. This requires a little bit of trial and error. But, in the end, it pays big.

What is the best passive income source?

There are many different ways to make online money. But most of them require more time and effort than you might have. How can you make extra cash easily?

Finding something you love is the key to success, be it writing, selling, marketing or designing. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

Another option is to start a blog. You'll need to choose a topic that you are passionate about teaching. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

Although there are many ways to make money online you can choose the easiest. You can make money online by building websites and blogs that offer useful information.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is called content marketing, and it's a great method to drive traffic to your website.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

How to Make Money online

How to make money online today differs greatly from how people made money 10 years ago. Your investment strategy is changing. While there are many methods to generate passive income, most require significant upfront investment. Some methods are simpler than others. However, there are many things you need to do before investing your hard-earned funds in anything online.

-

Find out which type of investor you are. If you're looking to make quick bucks, you might find yourself attracted to programs like PTC sites (Pay per click), where you get paid for simply clicking ads. You might also consider affiliate marketing opportunities if your goal is to make long-term money.

-

Do your research. Research is essential before you make any commitment to any program. Check out past performance records and testimonials before you commit to any program. You don't want to waste your time and energy only to realize that the product doesn't work.

-

Start small. Do not rush to tackle a huge project. Start small and build something first. This will allow you to learn the ropes and help you decide if this business is for you. Once you feel confident enough to take on larger projects.

-

Get started now! It's never too early to begin making money online. Even if you have been working full-time for years you still have time to build a strong portfolio of niche websites. All you need is a good idea and some dedication. So go ahead and take action today!