A legitimate payday loan consolidation firm is a good option if you're looking to consolidate your debt. These companies specialize in combining payday loans and can offer you a range of helpful services. We will be looking at what to expect from a legitimate company and the requirements for consolidating payday loans.

What are the requirements to apply for a loan?

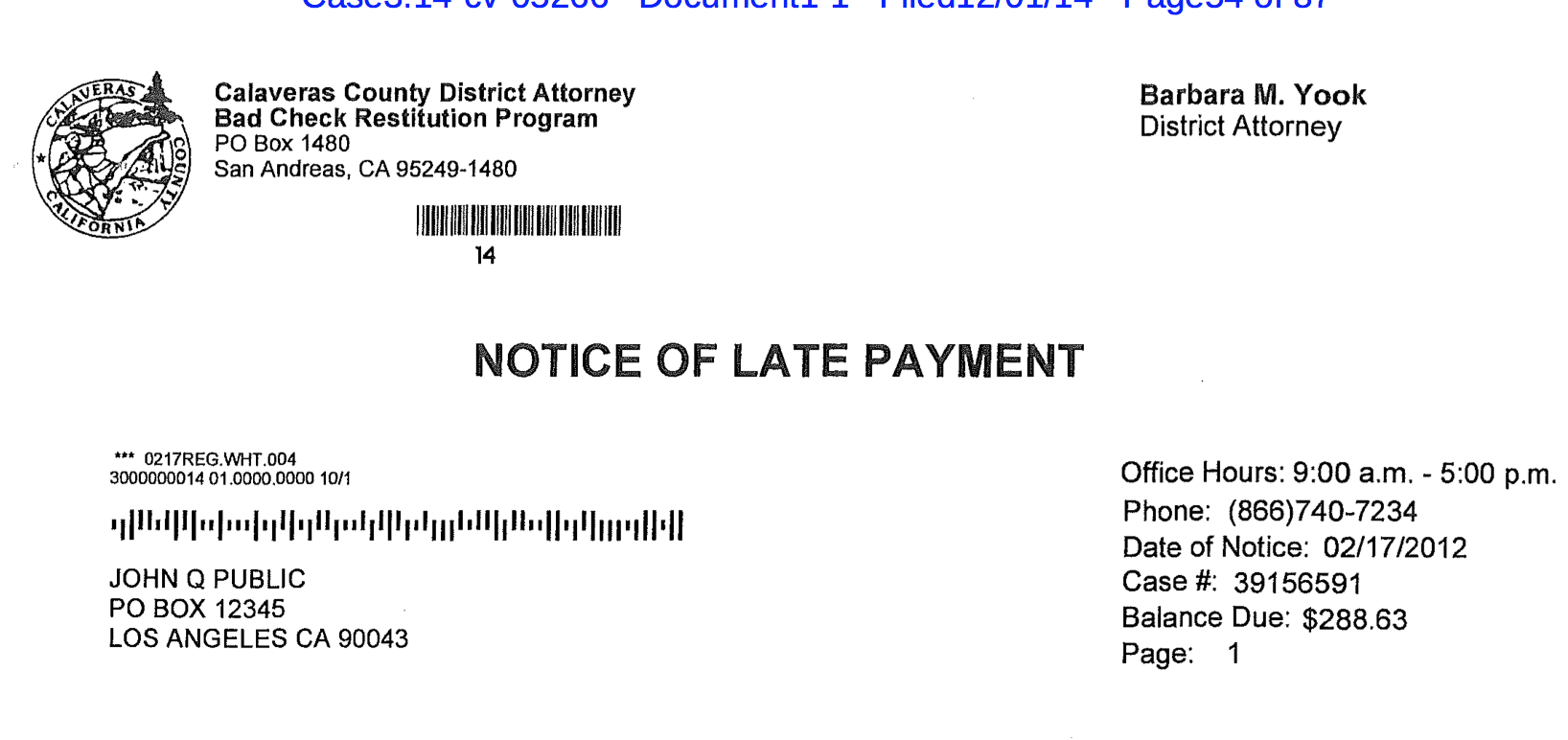

You must have a minimum of $1,000 in your account to be eligible for a loan through a consolidation payday loan company. Apply online or in person at a local lender. It is important to compare rates so you don't overpay. Most lenders offer a prequalification process that doesn't affect your credit score. Once approved for a loan, you must repay it within the stipulated time. Failure to pay your loan on time can lead to late fees or credit bureau reporting.

Payday loan consolidation programs work by working with a company that represents the borrower to lenders. This company is also called a credit management company, a debt settlement agency or a company that manages debt. The company will work closely with you to negotiate lower fees or interest rates. The fees for a payday loan are generally lower than those charged by the company, and the loan is paid back over a longer term.

Consolidation of payday loans: What is the cost?

Payday loan consolidation is a good option for borrowers looking to consolidate all of their payday loans into one monthly payment. It makes life easier by eliminating the need to pay high interest rates on several installments each month. Instead of making multiple payments each month, borrowers pay one monthly amount to a single company. This company pays all their payday lenders on their behalf. Additionally, a payday loan consolidation company does not report debt to credit bureaus, which means that it will not appear on the debtor's credit report.

Borrowers who are stuck in a cycle or have difficulty paying their bills can consolidate their payday loan debt. Payday loans have short repayment terms and high interest rates. Many borrowers end the process by rolling over existing debts to new loans. However, there are also other options, such as rollovers, debt management plans (DMPs), and Chapter 7 bankruptcy. You should do the math before taking out a consolidation loan for payday loans.

Legality of consolidation loans

By consolidating loans, payday loan consolidation companies reduce the amount owed. This is because it allows them to make one monthly payment rather than multiple. Overdraft fees, debt collection companies and the contact of borrowers can result from having multiple payments. These actions can even lead to lawsuits.

Payday loan consolidation can be used in the same manner as other debt consolidation programs. Your lenders will be contacted by the lender to help reduce your balance. The lender will examine your interest rates and negotiate for a lower monthly repayment. The consolidation company might offer you a consolidation loan to pay off your debts. If you don't qualify for the loan, you will still have to pay your debts manually after you get the money.

Signs that a company is legit

First, ensure that you verify the physical address of the company. Legitimate businesses will have a business location on their website or Google maps. If no address is listed, it's likely that it is a scam. Unresponsiveness to complaints and reviews are another indicator that a scammer is operating. There are many scams in debt consolidation so keep your eyes open. You can avoid falling for these scammers by using the tips above.

A legitimate payday loan consolidation firm does not charge upfront fees. False companies will charge an upfront fee for their service. A legit company will also follow the FTC guidelines. Don't waste any time getting a quote via phone or email that doesn't mention fees.

FAQ

Why is personal finance important?

A key skill to any success is personal financial management. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why then do we keep putting off saving money. Is there something better to invest our time and effort on?

Yes and no. Yes, most people feel guilty saving money. It's not true, as more money means more opportunities to invest.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

You must learn to control your emotions in order to be financially successful. You won't be able to see the positive aspects of your situation and will have no support from others.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. You don't know how to properly manage your finances.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting is the practice of setting aside some of your monthly income for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

How much debt is too much?

It's essential to keep in mind that there is such a thing as too much money. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. So when you find yourself running low on funds, make sure you cut back on spending.

But how much do you consider too much? There is no universal number. However, the rule of thumb is that you should live within 10%. You'll never go broke, even after years and years of saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. You should not spend more than $2,000 a month if you have $20,000 in annual income. Spend no more than $5,000 a month if you have $50,000.

This is where the key is to pay off all debts as quickly and easily as possible. This includes credit card bills, student loans, car payments, etc. When these are paid off you'll have money left to save.

It's best to think about whether you are going to invest any of the surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. You can still expect interest to accrue if your money is saved.

For example, let's say you set aside $100 weekly for savings. That would amount to $500 over five years. After six years, you would have $1,000 saved. In eight years you would have almost $3,000 saved in the bank. It would take you close to $13,000 to save by the time that you reach ten.

At the end of 15 years, you'll have nearly $40,000 in savings. This is quite remarkable. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000 in savings, you would have more than 57,000.

You need to be able to manage your finances well. Otherwise, you might wind up with far more money than you planned.

Is there a way to make quick money with a side hustle?

To make money quickly, you must do more than just create a product/service that solves a problem.

You need to be able to make yourself an authority in any niche you choose. It is important to establish a good reputation online as well offline.

Helping others solve problems is the best way to establish a reputation. So you need to ask yourself how you can contribute value to the community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. There are many online ways to make money, but they are often very competitive.

When you really look, you will notice two main side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has its pros and cons. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. These gigs can be very competitive.

Consulting helps you grow your company without worrying about shipping goods or providing service. However, it can take longer to be recognized as an expert in your area.

To be successful in either field, you must know how to identify the right customers. It will take some trial-and-error. But, in the end, it pays big.

What is the easiest way to make passive income?

There are many ways to make money online. Most of them take more time and effort than what you might expect. How can you make it easy for yourself to make extra money?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here's a collection of 101 affiliate marketing tips & resources.

A blog could be another way to make passive income. It's important to choose a topic you are passionate about. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

Although there are many ways to make money online you can choose the easiest. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is content marketing. It's an excellent way to bring traffic back to your website.

How do wealthy people earn passive income through investing?

There are two options for making money online. You can create amazing products and services that people love. This is called earning money.

You can also find ways to add value to others, without having to spend your time creating products. This is known as "passive income".

Let's assume you are the CEO of an app company. Your job is to create apps. But instead of selling the apps to users directly, you decide that they should be given away for free. This is a great business model as you no longer depend on paying customers. Instead, advertising revenue is your only source of income.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how most successful internet entrepreneurs earn money today. Instead of making money, they are focused on providing value to others.

What is the difference between passive income and active income?

Passive income is when you make money without having to do any work. Active income requires hard work and effort.

If you are able to create value for somebody else, then that's called active income. It is when someone buys a product or service you have created. This could include selling products online or creating ebooks.

Passive income allows you to be more productive while making money. Many people aren’t interested in working for their own money. Therefore, they opt to earn passive income by putting their efforts and time into it.

The problem with passive income is that it doesn't last forever. If you wait too long to generate passive income, you might run out of money.

You also run the risk of burning out if you spend too much time trying to generate passive income. It is best to get started right away. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types or passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

Statistics

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

How to Make Money Online

How to make money online today differs greatly from how people made money 10 years ago. How you invest your funds is changing as well. There are many ways to earn passive income, but most require a lot of upfront investment. Some methods are more difficult than others. However, there are many things you need to do before investing your hard-earned funds in anything online.

-

Find out what kind investor you are. If you're looking to make quick bucks, you might find yourself attracted to programs like PTC sites (Pay per click), where you get paid for simply clicking ads. On the other hand, if you're more interested in long-term earning potential, then you might prefer to look at affiliate marketing opportunities.

-

Do your research. Do your research before you sign up for any program. Look through past performance records, testimonials, reviews. You don't want your time or energy wasted only to discover that the product doesn’t work.

-

Start small. Do not rush to tackle a huge project. Instead, you should start by building something small. This will help to you get started and allow you to decide if this type business is right for your needs. You can expand your efforts to larger projects once you feel confident.

-

Get started now! It's never too early to begin making money online. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All that's required is a good idea as well as some commitment. Now is the time to get started!