This article will discuss how to calculate credit debt ratio, which criteria lenders use to determine borrowing power, and the impact of high debt ratios on credit scores. We'll also give some tips for lowering your debt ratio. This information should help you make the best borrowing decisions. We will also discuss some common causes of high credit debt.

Calculating credit debt ratio

In order to determine whether you're a qualified candidate for a loan or not, lenders often calculate your debt to credit ratios. They prefer to see this ratio below 30%. Higher ratios signal that you're a risky borrower and hurt your score. However, there are ways to lower your debt-to-credit ratio and avoid the consequences of a high ratio.

Your credit card debt can be reduced by paying off your balances. If your credit card balances exceed 30%, your credit score will rise. You should also pay off your balances as much as possible. A low debt-to-credit ratio will allow you to make smart decisions about borrowing money or purchasing credit. Monitor your ratio to see if you can make more than the minimum payment.

Lenders determine borrowing power using criteria

Lenders calculate borrowing power based on a person's financial situation and credit score. The higher the score, the higher the borrowing power. A higher score can mean that you will be able borrow more money and have better interest rates. Before you apply for a loan regardless of credit score, there are several things you need to remember.

The first step in determining borrowing power is analyzing the borrower's income. The real-life serviceability calculation is used for this purpose. This calculator is similar to those used by most banks. Next is to determine if the borrower has the ability to pay the loan.

Credit Score and effects of high credit debt

The debt-to-credit ratio is one of the most important factors that determine a person's credit score. The lower your debt-to-credit ratio, the better. The ideal ratio is lower than 10% and you want it to be under 30%. A low ratio does not necessarily mean that you cannot responsibly use credit. However, a high ratio may indicate that your finances aren't being managed properly.

Credit scoring also considers your credit utilization ratio, which is determined by your balances to your available credit. A high debt-to-credit ratio will negatively impact your score, so make sure you're not maxing out your cards. To maintain a good credit rating, it is best to have a low utilization ratio and a low amount of debt-to-credit.

You can lower it.

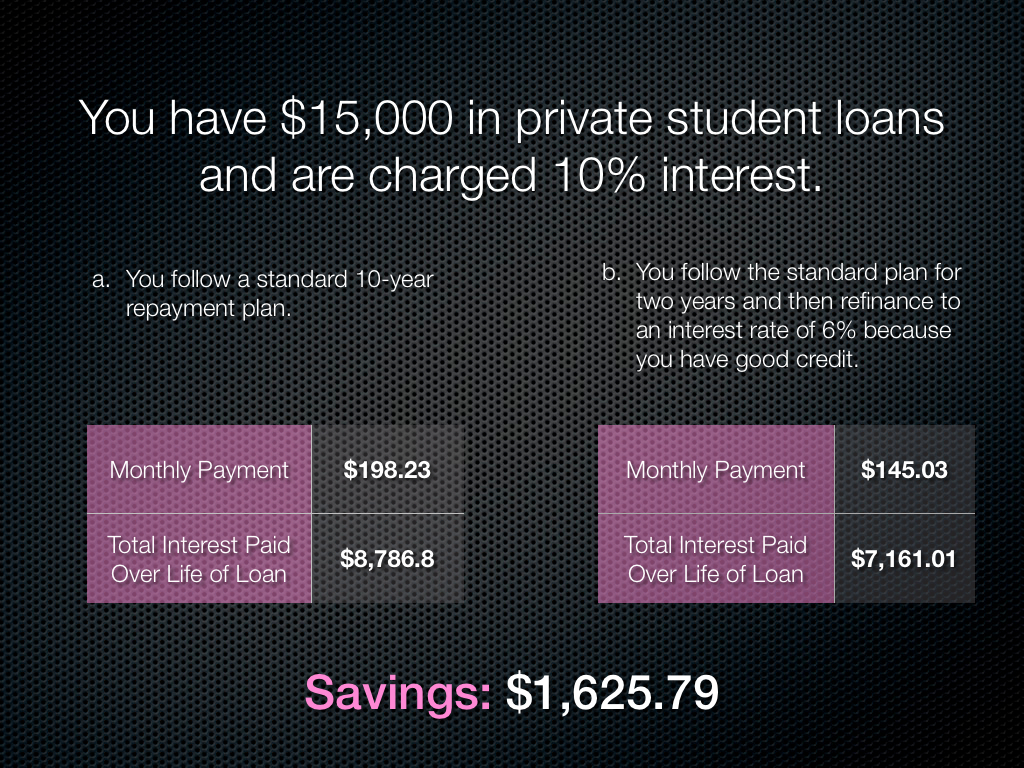

There are many methods to reduce your credit debt ratio (DTI), as well as credit score. To avoid more debt, the first step is to stop taking it on. Your DTI will only increase if you have more debt. Avoid this problem by only applying for what is necessary. Try using a debt snowball calculator to determine which debts you can pay off first. To reduce your debt, you can also look into debt consolidation.

You can also increase your income. It's possible to increase your income by increasing your debt-to-income ratio. However, it might not be healthy to have a high debt/income ratio if there are many payments. A good way to increase your income is to get an additional job, ask for a raise, or start a part-time business. These ways will increase your income without increasing your monthly debt payments.

FAQ

How can rich people earn passive income?

There are two ways you can make money online. The first is to create great products or services that people love and will pay for. This is called earning money.

Another way is to create value for others and not spend time creating products. This is called "passive" income.

Let's say that you own an app business. Your job is to develop apps. You decide to give away the apps instead of making them available to users. It's a great model, as it doesn't depend on users paying. Instead, you can rely on advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is the way that most internet entrepreneurs are able to make a living. They give value to others rather than making stuff.

Why is personal finances important?

If you want to be successful, personal financial management is a must-have skill. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why then do we keep putting off saving money. Is there anything better to spend our energy and time on?

Yes and no. Yes, as most people feel guilty about saving their money. It's not true, as more money means more opportunities to invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

To become financially successful, you need to learn to control your emotions. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. This is because you aren't able to manage your finances effectively.

After mastering these skills, it's time to learn how to budget.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

What is the limit of debt?

It is important to remember that too much money can be dangerous. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. When you run out of money, reduce your spending.

But how much do you consider too much? There's no right or wrong number, but it is recommended that you live within 10% of your income. You'll never go broke, even after years and years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. You shouldn't spend more that $2,000 monthly if your income is $20,000 If you earn $50,000, you should not spend more than $5,000 per calendar month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans, credit card debts, car payments, and credit card bill. Once these are paid off, you'll still have some money left to save.

It's best to think about whether you are going to invest any of the surplus income. You could lose your money if you invest in stocks or bonds. But if you choose to put it into a savings account, you can expect interest to compound over time.

As an example, suppose you save $100 each week. That would amount to $500 over five years. Over six years, that would amount to $1,000. In eight years you would have almost $3,000 saved in the bank. By the time you reach ten years, you'd have nearly $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. That's pretty impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. You'd have more than $57,000 instead of $40,000

It is important to know how to manage your money effectively. You might end up with more money than you expected.

How to build a passive stream of income?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

This means that you must understand their wants and needs. It is important to learn how to communicate with people and to sell to them.

You must then figure out how you can convert leads into customers. You must also master customer service to retain satisfied clients.

Even though it may seem counterintuitive, every product or service has its buyer. And if you know who that buyer is, you can design your entire business around serving him/her.

You have to put in a lot of effort to become millionaire. You will need to put in even more effort to become a millionaire. Why? You must first become a thousandaire in order to be a millionaire.

Finally, you can become a millionaire. You can also become a billionaire. The same is true for becoming billionaire.

How does one become a billionaire, you ask? It starts by being a millionaire. To achieve this, all you have to do is start earning money.

However, before you can earn money, you need to get started. Let's take a look at how we can get started.

Which side hustles are most lucrative?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles provide extra income for fun activities and bills.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types of side hustles: passive and active. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. You can also do side hustles like tutoring and dog walking.

Side hustles that are right for you fit in your daily life. You might consider starting your own fitness business if you enjoy working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

Side hustles can be found anywhere. You can find side hustles anywhere.

If you are an expert in graphic design, why don't you open your own graphic design business? Maybe you're a writer and want to become a ghostwriter.

Be sure to research thoroughly before you start any side hustle. If the opportunity arises, this will allow you to be prepared to seize it.

Side hustles aren’t about making more money. They're about building wealth and creating freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

What side hustles will be the most profitable in 2022

You can make money by creating value for someone else. If you do this well the money will follow.

It may seem strange, but your creations of value have been going on since the day you were born. Your mommy gave you life when you were a baby. Learning to walk gave you a better life.

You'll continue to make more if you give back to the people around you. Actually, the more that you give, the greater the rewards.

Everyone uses value creation every day, even though they don't know it. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

In fact, there are nearly 7 billion people on Earth right now. This means that every person creates a tremendous amount of value each day. Even if you only create $1 worth of value per hour, you'd be creating $7 million dollars a year.

If you could find ten more ways to make someone's week better, that's $700,000. You would earn far more than you are currently earning working full-time.

Now, let's say you wanted to double that number. Let's say you found 20 ways to add $200 to someone's life per month. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

Every day offers millions of opportunities to add value. This includes selling ideas, products, or information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. Helping others achieve theirs is the real goal.

To get ahead, you must create value. Use my guide How to create value and get paid for it.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How to Make Money Online

It is much easier to make money online than it was 10 years ago. Your investment strategy is changing. While there are many methods to generate passive income, most require significant upfront investment. Some methods are more difficult than others. There are a few things to consider before you invest your hard-earned money into any online business.

-

Find out what kind of investor you are. PTC sites (Pay Per Click) are great for those who want to quickly make a quick buck. They pay you to simply click ads. Affiliate marketing is a better option if you are more interested in long-term earnings potential.

-

Do your research. Research is essential before you make any commitment to any program. Read through reviews, testimonials, and past performance records. It is not worth wasting your time and effort only to find out that the product does not work.

-

Start small. Do not jump into a large project. Instead, you should start by building something small. This will help you learn the ropes and determine whether this type of business is right for you. Once you feel confident enough to take on larger projects.

-

Get started now! It's never too soon to start making online money. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. You just need a good idea, and some determination. Now is the time to get started!